Fueled by new tariffs, supply chain volatility, and unpredictable commodity markets, in April 2025 input costs surged at the highest rate in over two years. For manufacturers inflation is more than a margin pressure. It’s a stress test of financial gymnastics.

So here is the question: Is your finance system built to navigate this extreme volatility or was it designed to survive only when business is stable?

Many companies rely on fragmented data, spread sheets and outdated workflows that make it nearly impossible to respond in real time. That widening customer service gap can become a serious problem.

Current Key Limitations

- Inefficient and Hidden Cost Structures: Outdated financial systems tend to mask non-value-added activities (waste). Manual reconciliation, duplicate data entry, and siloed workflows inflate administrative costs and leave little visibility into what is driving your spend.

- Compliance and Risk Exposure: Maintaining compliance with evolving financial and industry-specific regulations is more resource-intensive. Failure to comply risks fines and legal action but even worse, reputational damage—challenges that traditional systems are ill-equipped to overcome.

- Unreliable, Fragmented Data: Many finance teams still operate with siloed data sources (e.g. overreliance on disparate spreadsheets). This fragmentation undermines decision-making, exacerbates inconsistencies, and introduces significant risk into financial planning and analysis (FP&A).

Financial Visibility & Control

By leveraging Infor’s integrated financial suite, this organization achieved measurable results:

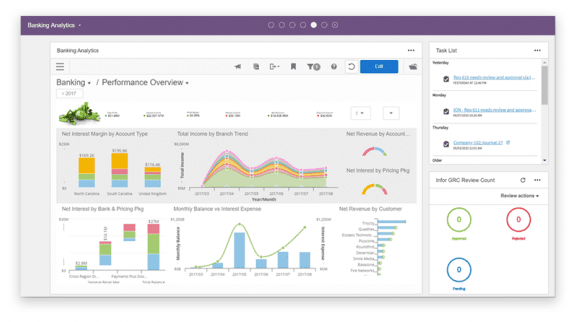

- End-to-End Visibility: Infor offers a unified financial view with KPI analytics, enabling real-time decisions on materials, margins, and cash flow.

- Granular Costing: Support for actual and standard costing (FIFO, LIFO, Average, Lot) by part or part group enables fine-tuned margin control across all production types.

- Compliance Made Easy: Support for multi-jurisdiction tax and audit reporting reduces overhead and risk.

Process Intelligence & Automation

- Process Mining: Identify hidden inefficiencies and compliance risks leading to a positive transformation.

- Role-Based Process Modeling: Personalized for each user.Will improve cross-functional collaboration and optimize workflows before they become problems.

- RPA Integration: Automate routine finance tasks—like bank reconciliations and AP Automation—your teams will have more time to focus on business improvement strategies.

Strategic Decision Making

- Real-Time Margin Insights: Variance analysis between estimated & selling prices versus production costs to know true profitability by customer, order or product.

- Agile Resource Allocation: Shifts your spending and headcount based on only what creates value.

Outcome

In just six months using Infor, the mid-sized manufacturer reduced unnecessary costs by 18% and improve forecasting accuracy by 30%. An example of a fully executed finance strategy. The companies that succeed will not be those with the most data—they will be those that can act proactively with real time insights.

How are you currently managing cost volatility in raw materials and labor?

Infor allows finance professionals to replace volatility with a competitive advantage. Are you ready to lead your industry?